2024 Business Deduction Changes Chart

2024 Business Deduction Changes Chart – Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . Small and medium-size businesses have struggled with a change in tax rules on R&D expenses. Lawmakers may soon repeal it, but the effects will linger. .

2024 Business Deduction Changes Chart

Source : wilkecpa.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comMcDaniel & Associates, P.C. | Dothan AL

Source : www.facebook.comProjected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.comFederal Solar Tax Credits for Businesses | Department of Energy

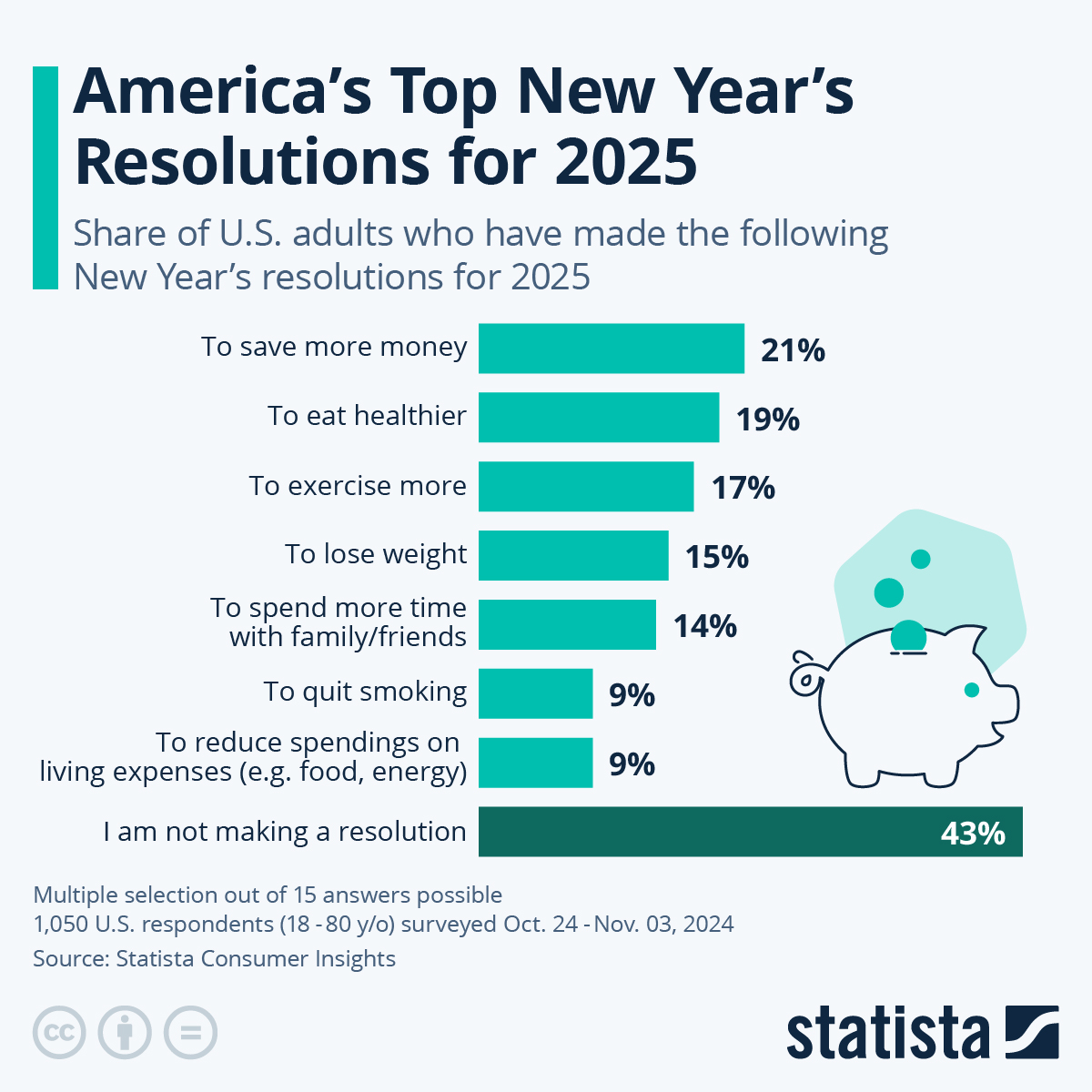

Source : www.energy.govChart: America’s Top New Year’s Resolutions for 2024 | Statista

Source : www.statista.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govAshby W. Price, CFA, AIF, CRPS | Richmond VA

Source : www.facebook.com2024 Business Deduction Changes Chart Key 2024 Tax Changes Wilke CPAs & Advisors: Some of the proposed changes would issuers have until the next business day. You can find due dates for some other popular tax forms here. What is the standard deduction for 2023? . If you purchase assets for your business during If you change your mind, you can make or revoke the decision to take the Section 179 tax deduction after your tax return is filed. .

]]>